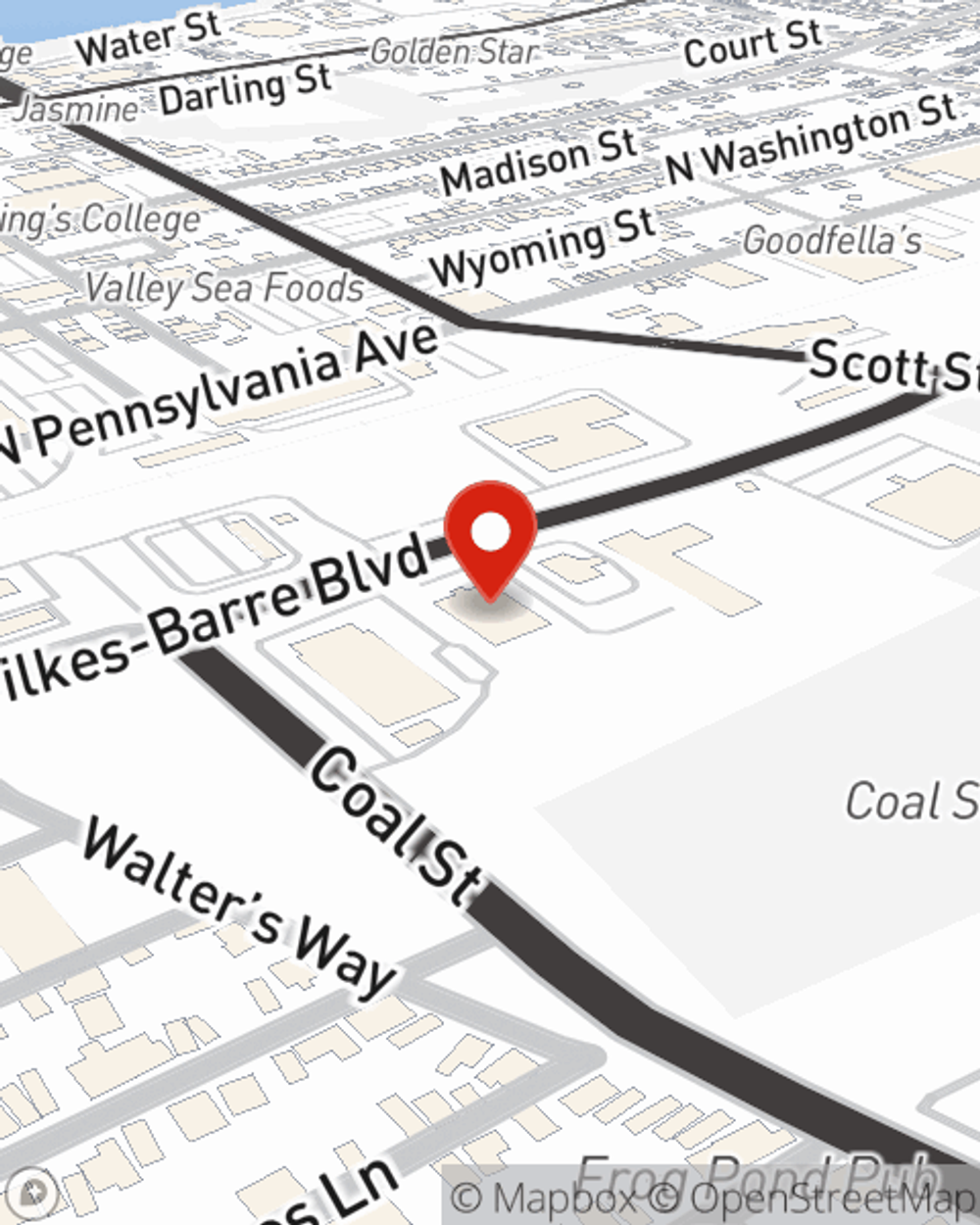

Business Insurance in and around Wilkes Barre

One of Wilkes Barre’s top choices for small business insurance.

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Eric Rivera help you learn about quality business insurance.

One of Wilkes Barre’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Business With State Farm

For your small business, whether it's a dry cleaner, a photography business, a window treatment store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, equipment breakdown, and loss of income.

Get in touch with the terrific team at agent Eric Rivera's office to discover the options that may be right for you and your small business.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Eric Rivera

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.